22 September 2017

OIC member countries to establish financial inclusion working group

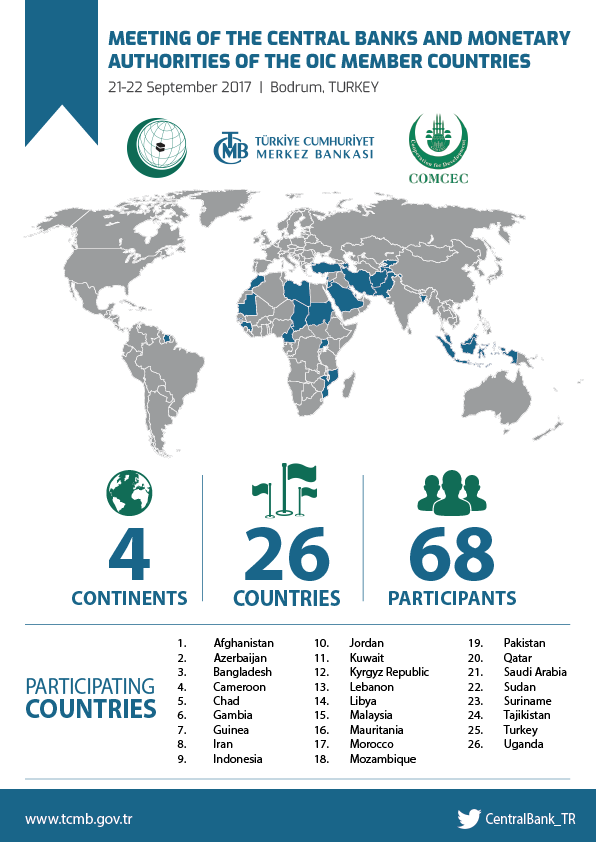

The governors of the central banks and the head of delegations of the Organization of Islamic Cooperation (OIC) member countries agreed to establish a working group on financial inclusion during the Meeting of the Central Banks and Monetary Authorities of the Organization of Islamic Cooperation (OIC) Member Countries held on 21–22 September in Bodrum, Turkey.

“In order to promote financial inclusion, efforts toward improving access to finance, financial education and consumer protection need to proceed in a coordinated and synchronized manner”, the regulators said in a joint communique emphasizing financial inclusion as a “key enabler to reducing poverty and boosting prosperity”, with more efforts needed in OIC countries to address these issues.

The OIC financial leaders also recognized that the Islamic finance has become an important part of financial inclusion and financial stability in the global economy. “We are of the view that enhancing the variety of Islamic financial products, including Islamic social finance and their wide acceptance would further strengthen the role and impact of Islamic finance,” they said adding that they support the efforts that aim to align Islamic finance related practices with international regulatory principles and standards.

During the meeting, AFI Deputy Executive Director Norbert Mumba emphasized that “financial inclusion and financial stability need to coexist”.

“Financial inclusion enables economically and socially excluded to participate and contribute to inclusive growth,” Mumba explained, during his presentation “Fostering Stable and Inclusive Financial Systems – Two Sides of a Coin”, adding that “sustainable financial inclusion requires a systemic effort which leverages technology, viable business models and appropriate regulatory framework cohesively”.

Citing the Bali Outcome Statement, Mumba highlighted the positive effects of financial inclusion on economic growth and financial stability. He specified that such efforts should be conducted on the footing of solid financial system supervision and sound regulatory environment. Mumba also underlined the need for the development of a set of indicators that reflect a healthy balance between financial stability and financial inclusion.

© Alliance for Financial Inclusion 2009-2025