28 September 2020

NFIS Policy Model: codifying best practices

By Dieter De Smet, Financial Inclusion Strategy Policy Manager, AFI

Members unanimously ratified the National Financial Inclusion Strategy (NFIS) Policy Model at the AFI Annual General Meeting on 9 September 2020, providing key regulatory and policy guidance on NFIS development and implementation.

Codifying over 10 years of developing and implementing NFIS to further members’ financial inclusion goals, the policy model harnesses the extensive experience of members in providing best practice policy and technical guidance. It also presents invaluable insight for those seeking to launch their first NFIS or wishing to revise an existing or upcoming NFIS.

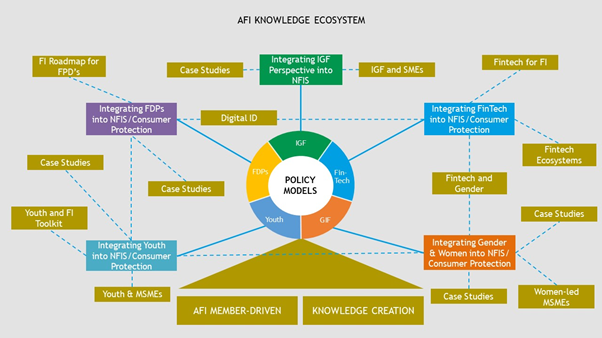

The policy model lies at the heart of AFI’s member-driven knowledge ecosystem on NFIS and connects different policy model components to specific AFI knowledge products that provide more detailed and actionable information. These include knowledge products on stakeholder coordination, monitoring and evaluation, diagnostics, gender, inclusive green finance and digital financial services.

NFIS lifecycle

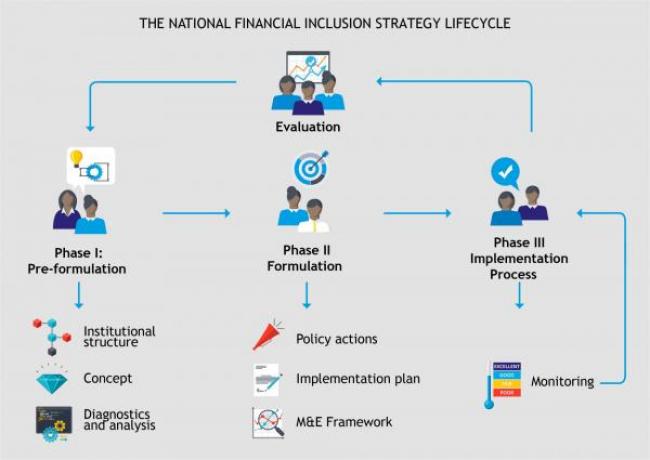

The policy model is built around the NFIS lifecycle, which consists of three key phases – pre-formulation, formulation and implementation/evaluation – with a continuous monitoring feedback loop to keep progress on track and achieve the pre-determined financial inclusion goals.

Laying the foundation of a NFIS by providing a roadmap of guiding principles to achieve pre-formulation phase deliverables, the policy model includes comprehensive diagnostics and analysis to assess the current state of financial inclusion, NFIS institutional structure and mechanisms, and an NFIS concept paper.

While close cooperation with stakeholders and political leaders is vital throughout the NFIS lifecycle, it is particularly crucial at this initial stage. Here, stakeholder buy-in and strategy ownership is needed to reach a consensus on the direction of NFIS activities to achieve financial inclusion goals.

During the next stage – the formulation phase – the policy model charts the main prioritized policy actions to help identify targeted markets segments and strategic frameworks while also establishing an implementation plan and framework for monitoring and evaluation. All these elements are incorporated into an NFIS by the time it is ready to be launched.

Finally, the policy model outlines the guiding principles of the implementation phase. This is supported by a monitoring and evaluation framework that allows for adjustments in the implementation plan and a proper alignment of stakeholders to ensure the clear distribution of roles and responsibilities to prevent any gaps or overlap. Post-implementation, an evaluation report assesses the results achieved and areas for improvement. This information is then integrated into a new or updated NFIS, and the lifecycle starts afresh.

NFIS Policy Model characteristics

While the policy model contains the blueprints of policy areas and actions, it does not propagate a one-size-fits-all model. Policymakers must use the policy model and carefully select relevant and high-impact components that consider country-specific contexts. As countries face different circumstances and challenges, the indicative list of policy areas and actions aims to be outcome-centric rather than leaning towards a specific process.

By providing the NFIS best practice experiences of all 99 AFI members, the policy model is a truly unique knowledge product as it compiles the practical approaches and ideas that worked to produce desired financial inclusion results. We, therefore, encourage those who are interested in furthering financial inclusion to use this policy model as a reference for their NFIS that underpins many other AFI member-driven financial inclusion knowledge products.

The NFIS Policy Model can be found here. Other NFIS-related knowledge products can be downloaded via the AFI website.

© Alliance for Financial Inclusion 2009-2024