20 April 2018

Bangladesh Bank steers the financial sector towards environmental sustainability & climate change resilience

In Bangladesh, climate change affects many sectors, including water resources, agriculture and food security, ecosystems and biodiversity, and human health and coastal zones. It is estimated that rising sea levels alone will displace 18 million Bangladeshis within the next 40 years; also predicted that climate change could have a devastating impact on agriculture — a key economic driver in Bangladesh, accounting for nearly 20 percent of the GDP and 65 percent of the labor force.

The adoption of green investments

As a result, the government of Bangladesh is prioritizing mainstreaming sustainability into the financial sector. Key elements of the country’s inclusive socio-economic development strategy include environmental sustainability and climate change resilience.

Green investments are being used in adoption of carbon emission minimizing, and energy-efficient output processes and practices, with support measures including tariff waivers, and tax holidays for renewable energy. Significant progress has already been attained including rapidly expanding solar home systems, solar irrigation pump and solar and biomass-based energy. The organic farming sector is growing fast, producing both for export and domestic consumption.

The first strategic step towards sustainability

Bangladesh Bank (BB), the monetary and financial sector regulator in Bangladesh, has a well-coordinated green finance framework — its first strategic step towards a sustainable and inclusive financial system.

Central banks have wide-ranging effects on the economy and society as a whole; policy space is defined as indispensable for a sound analysis of the connections between sustainability, and actions taken by the central bank. Mandated by BB’s charter to support output, and employment growth besides monetary protection, and financial stability, BB stepped in to impart a deliberate directional bias in financing flows away from speculative investment, and towards inclusive financing of ‘green’ output initiatives.

To this end, BB has been pursuing a host of concerted initiatives drawn up consultatively with financial intermediaries, and target client bases in relevant market segments. And, profoundly, more focus have been placed on women and vulnerable segments.

Green finance flows

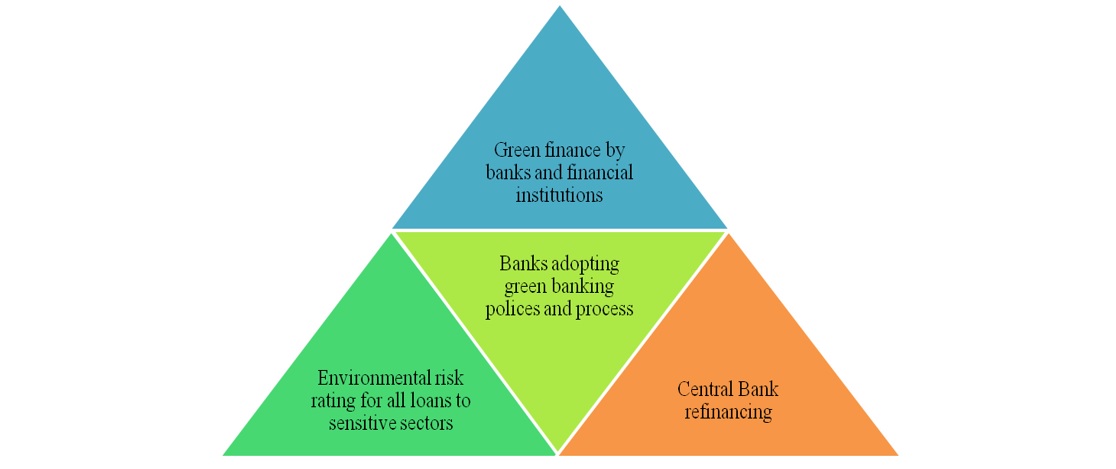

For green financing, Bangladesh Bank (BB) has provided banks and financial institutions with framework guidelines consistent with national environmental laws and regulations. The guidelines also keep up with evolving international best practices to be used and modified by individual institutions as needed to fit in with their client segments; in assessing and grading of environmental risks associated with projects seeking financing. Therefore, their financing decisions are now factoring in environmental risks, financing only those that have the needed risk mitigation features.

Cascade of green finance flows and behaviors

Lenders for example, microfinance institutions, can finance renewable energy projects with low-cost refinance support from BB through the refinancing scheme aimed at SMEs and households.

Green projects supported through this scheme include solar home systems, solar mini grid, solar powered irrigation, solar PV panel assembly, bio-fuel, effluent treatment, replacement of polluting brick baking kilns with energy efficient ones, organic compost, pico-, micro- and mini- scale hydropower, PET bottle recycling, solar battery recycling, and LED bulb manufacturing — stimulating innovation in many sectors in Bangladesh.

Broadening green initiatives

Bangladesh Bank (BB)’s green financing promotion initiative have heightened the awareness and engagement of the financial sector significantly, in green investment opportunities within Bangladesh.

Current green investments supported by BB are small-sized; current and future investments will face further challenges ahead in mobilizing financing and building capacity to increase the market for green, and sustainable finance. Scaling up these investments will ensure their sustained viability.

Therefore, BB intends to broaden its green financing promotion initiative, making it a platform for linking local green investment entrepreneurs, and financiers with technical expertise. BB remains eager to draw from experiences with similar initiatives elsewhere, as well as share its own experience for possible usefulness to others.

———-

This blog is part of a series of blog we will publish in the coming months on the emerging Financial Inclusion and Climate Change policy area, drawing insights and experience from AFI members who are pioneering a sustainable financial inclusion agenda. Read more about Bangladesh Bank’s financial inclusion strategy.

© Alliance for Financial Inclusion 2009-2024