6 December 2016

Denarau Action Plan and the rise of gender finance

For generations, there has been a widespread prevalence of economic and social barriers that inhibit the empowerment and economic inclusion of women in the global economy. There is extensive literature that discusses different challenges women face in their quest for equality, particularly in terms of access to finance irrespective of their socio-economic, demographic, and geographical circumstances. In the pursuit of sustainable financial inclusion, addressing this gender gap in terms of access and usage of financial services is one of the key priority areas amongst policymakers. Currently, there are over 1 billion women globally who are financially excluded from the formal financial system. Thus, the only way to have a genuine inclusive financial system is to incorporate gender dimension to financial inclusion strategies and goals.

During the 2016 Alliance for Financial Inclusion (AFI) Global Policy Forum (GPF) in Nadi, Fiji, the Members of AFI endorsed the Denarau Action Plan. At the heart of this plan is the commitment to close the gender gap in financial inclusion. As policymakers implement the Denarau Action Plan, there is a need to have an overarching “gender lens” approach. This means advancing the agenda of women’s financial inclusion whereby financial service providers serve women by acknowledging them as viable investors with strong business cases. The Action Plan will also assist regulators in identifying gender-specific policy gaps and addressing them with innovative smart policy solutions. The idea is to empower women using a collaborative model. This signals to all the relevant stakeholders that both men and women have crucial roles to play in reaching those 1 billion unbanked women around the world. It is a proactive approach which is more holistic and not only focusses on access to financial services but also emphasises designing policies with women for women.

However, there is no universal approach to solving this gender disparity when it comes to accessing financial products and services. As a result, different jurisdictions and regions need to tailor their strategies accordingly taking into consideration the cultural and political landscape. For example, in the Pacific region, the recent financial services demand side survey in a number of countries provided baseline data on access and usage of financial products and services. In addition, it also provided significant statistics in relation to the participation of women in the financial decision making and accessing financial services.

For instance, in Fiji and the Solomon Islands, gender parity in terms of access to financial services has not been achieved.

Source: Central Bank of Solomon Islands and Reserve Bank of Fiji

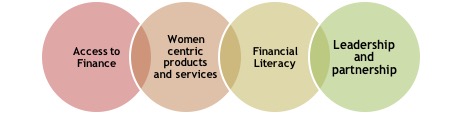

As part of the sample surveyed, a higher percentage of men have bank accounts in both countries and more women remain unbanked. While the survey did not look at the behavioural aspects in identifying the underlying causes of these figures, understanding the needs and barriers in accessing finance for women specifically has become a policy agenda for policymakers in the respective countries. For instance, as part of the new Maya Declaration Commitments, the Reserve Bank of Fiji has pledged to increase the percentage of new accounts by women in formal financial institutions from 52 percent to 72 percent by 2020. Hence, the goal would be to redefine financial inclusion for women through affordable and accessible finance, revolutionary products, improving financial competency, and opportunities for growth.

Access to finance is a key pillar in assisting women and women-owned SMEs in achieving economic and self-empowerment whilst reducing poverty. Making accessible and affordable financial products and services available to women – whether it’s a savings or credit product can be a catalyst in encouraging entrepreneurship and promoting sustainable livelihoods. There is a need to re-look at the regulatory environment to encourage more women into the formal channels of savings and borrowing.

Innovative products and channels such as digital savings can be an effective means of increasing access and usage of financial services by women. Financial service providers need to build their capacity in terms of conducting market research in identifying needs and preferences of women in terms of financial services. Gender-disaggregated data will be crucial to this process. There is scope for donor and developmental partners to explore partnerships with financial institutions in delivering customised products and services for unbanked and underserved women.

Financial Literacy becomes an integral skill as we promote financial inclusion amongst the vulnerable group including the underserved women. Being financially literate or competent enables one to make an informed decision and minimises the risk of over-indebtedness. It empowers women to carefully assess different options and choose a product or service that meets her needs. Lack of financial literacy skills is one of the key barriers women face in developing and small island development states.

Therefore, one thing that is clear is that advancing the agenda of gender finance will require a multi-stakeholder approach with women being at the helm of this movement. Moving forward, innovation will be key in supporting women to proactively grasp their full economic potential. Bold reforms and policy instruments such as quotas need to be explored (if need be) to start the conversation on the need for a more inclusive financial system.

ABOUT THE AUTHOR

Sameer Chand is a Senior Analyst at the Reserve Bank of Fiji, a member institution of the Alliance for Financial Inclusion.

© Alliance for Financial Inclusion 2009-2024