19 September 2016

Sharing Financial Inclusion Stories through Data

This article is adapted from a speech delivered on 8 September 2016 by Mr. Norbert Mumba, Deputy Executive Director, AFI, at the launch of the AFI Data Portal (ADP). Please sign up for your individual account to access the Portal via www.afi-dataportal.org. Anyone is eligible to access the ADP.

At the Alliance for Financial Inclusion (AFI) Financial Inclusion Data Working Group (FID WG) Meeting held in San Salvador, El Salvador, earlier this year, my colleague, Charles Marwa, Senior Monitoring and Evaluation Specialist at AFI, shared the idea that:

“Good data illuminates the world. It makes the invisible markets visible.”

When I reflect on this quote, I think about how good data can tell us stories about the world. In the financial inclusion sphere, good data informs us of the progress made in advancing financial inclusion over time. Good data also tells us the impact of national policies on the lives of its citizens.

But as a story can inform, it also has the power to mislead. Data collected and shared by individuals or organizations may contain certain biases. As key policymakers in charge of financial inclusion in your countries, you possess a set of data that can tell your country’s unique financial inclusion stories.

AFI was founded on the idea that a global knowledge exchange platform is key to expanding and improving financial inclusion policy.

As a member-driven organization, AFI’s founding principles are based on being a community where agendas are set by AFI members to harness the power of peer learning. For Instance, all AFI members endorse the Maya Declaration principles when they join the network and are expected to make specific commitments related to their financial inclusion strategies. We share knowledge on financial inclusion policies in working groups, member zone and forums such as the GPF so we can learn from our peers and they can learn from us.

As we continuously grow to meet the needs of our members, we are always seeking for ways to expand AFI’s culture of knowledge sharing. Today, AFI is proud to share with you the AFI Data Portal (ADP), a canvass for policymakers and regulators to share their financial inclusion stories through data.

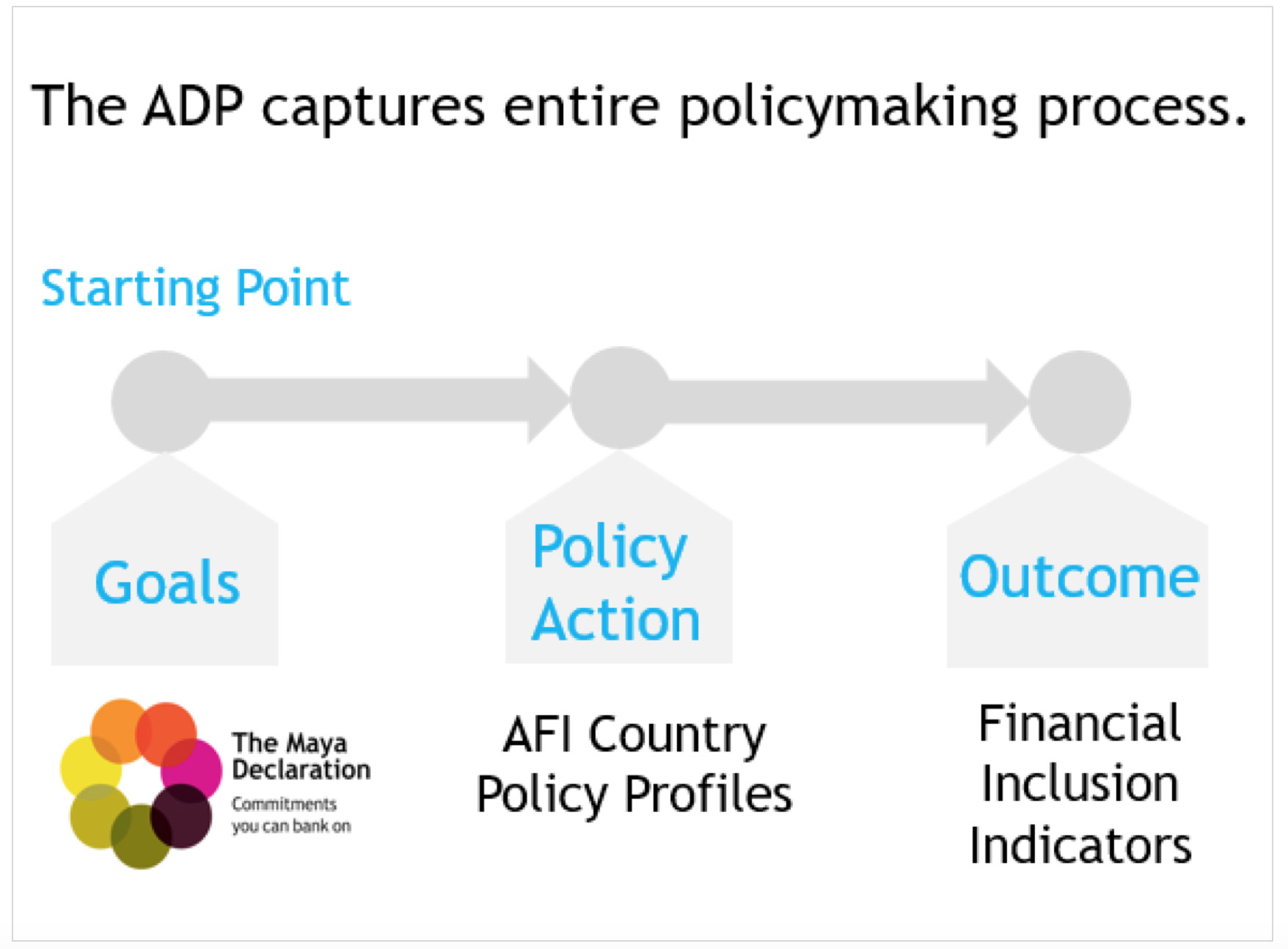

The ADP captures our members’ stories of financial inclusion that reflect the entire cycle of the policymaking process.

Stories start with the characters and intentions, aspirations, and goals about what they set out to achieve. In an analogy to the ADP, the characters are policymakers and regulators, people like many of you here, and intentions are their Maya Declaration Commitments.

Through the AFI Data Portal, members can set concrete goals under the Maya Declaration and share progresses they have made towards achieving them. This element is the most important as it stands at the core of our members delivering to their nationals, the much promised access to quality financial services. When your commitments are concrete and transparent, others such as your peers in the AFI network can know how best to help you achieve those goals.

The second key elements of stories are actions—what characters do to achieve their goals.

In the context of the ADP, these are statuses of financial inclusion policies and regulations of each country, with highlights on key aspects deemed important by our members. This is what we call AFI Country Policy Profiles. For example, does the country allow agent banking? Is there deposit insurance scheme for mobile money? Does the country have specific regulation on consumer protection?

The third and last key element of stories is of course the outcome, which tells you whether the characters end up achieving their goals. In the ADP, outcome is measured with Financial Inclusion Indicators data. Countries can report data on the AFI Indicators which are created by their peers in the AFI Working Groups. Countries may add their own country-specific indicators too in case the AFI indicators do not sufficiently measure financial inclusion reality of the countries.

These three datasets together do not represent static stories but in fact ‘living’ ones. The members have 24-7 real-time access to update and view their information. As the financial inclusion landscape evolves, new challenges will emerge.

You can now define new goals and commitments and create new policies and regulations, and monitor their impact. This cycle starts again and continues on as new opportunities and challenges arise. The ADP then turns into an eternal record of different countries’ journeys towards full financial inclusion. This will make the ADP a powerful resource—not only for peer learning but also for research, impact measurement, and alignment of global resources to support country-led initiatives. On this occasion, I would like to thank the Financial Inclusion Data Working Group (FID WG), which spearheads the idea of developing member-owned data portal. I also would like to thank White & Case LLC, our partner law firm that helps us collect the AFI Country Policy Profile data.

Today, we are still one step away from realizing the full potential of data sharing. The ADP was launched for members to access only in April this year. This means that researchers and other key stakeholders in financial inclusion face barriers to access key relevant information.

So, what does it mean to make the AFI Data Portal available for the public?

Sharing data to the public means facilitating researchers and stakeholders’ access to key financial inclusion data so that they can produce knowledge that can benefit us all.

It also means greater efficiency in data collection and sharing. Anyone can simply log on the ADP to obtain key financial inclusion information.

Ultimately, sharing this data to the public is about making the voices of policymakers and regulators louder and ensuring that other parties do not get to monopolize countries’ financial inclusion narratives. And when our collective voices are loud enough, they will start to shape the global agenda on financial inclusion too.

These are just few examples of benefits. The possibilities are infinite, but realizing them is only one step away—and we have taken that important step.

ABOUT THE AUTHOR

Norbert Mumba is Deputy Executive Director at the Alliance for Financial Inclusion.

© Alliance for Financial Inclusion 2009-2024