24 August 2016

From Natural Disaster to Financial Inclusion: Haiti a DFS Front-Runner

While Latin America has been experiencing fast economic growth over the last decade, progress in the Caribbean sub-region has been a bit slower. Natural disasters and low commodity prices have pushed Caribbean countries to seek financial reforms. In an attempt to overcome poverty, the largest countries in the region have been implementing financial inclusion policies and regulations for innovations like digital financial services.

So far, there are four AFI member countries from the Caribbean: Haiti, Jamaica, Suriname and Trinidad & Tobago. These members have all expressed a desire to develop policies on consumer protection, and they are also interested in digital financial services with a special emphasis on government payments, access to finance for MSMEs (particularly the development of credit infrastructure, such as credit bureaus) and policies that foster youth entrepreneurship (Alliance for Financial Inclusion (AFI) MNA, AFI Policy Profiles 2015).

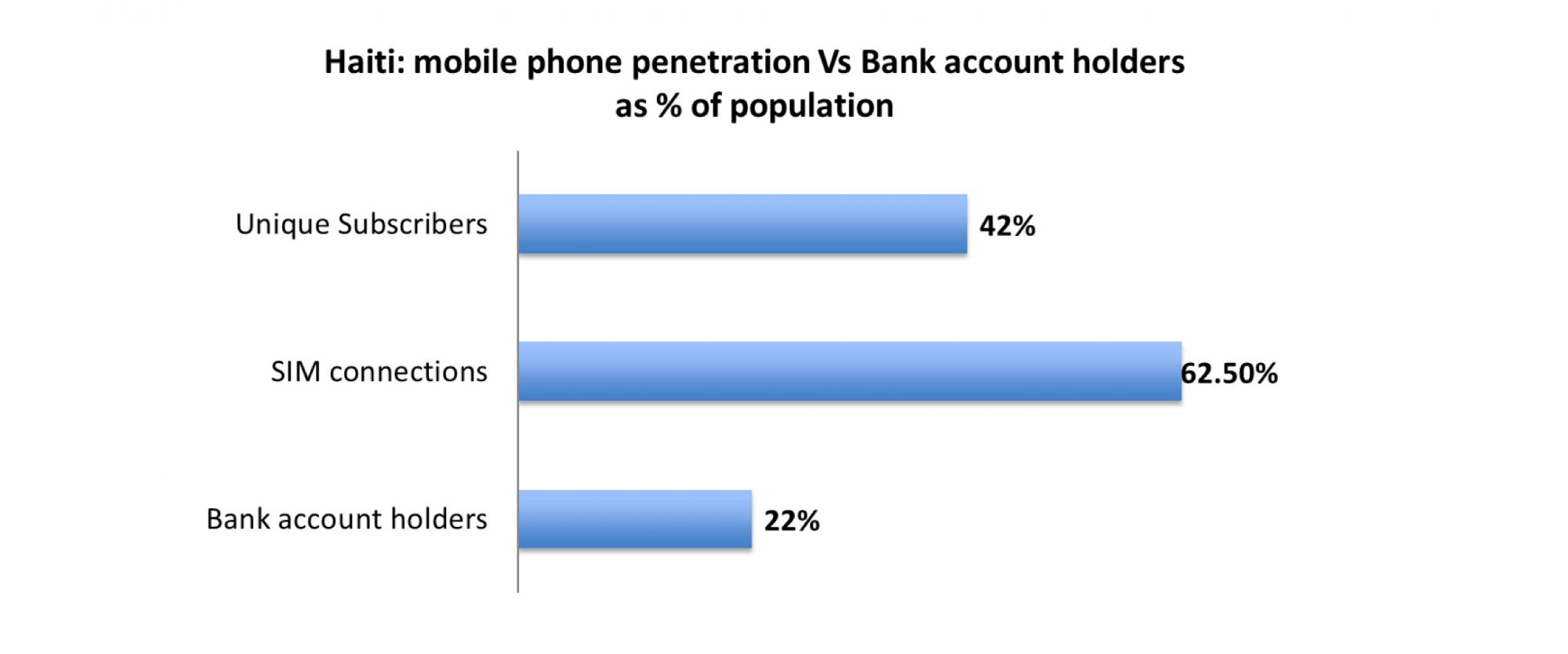

With regards to digital financial services, Haiti and Jamaica have been front-runners in the region since 2010 and 2012, respectively. Haiti’s experience has been particularly unique, and provides a window into the challenges and lessons of regulating in an emergency.

In 2010, Haiti experienced a terrible earthquake that triggered a major humanitarian tragedy. The country was in ruins, with no infrastructure. Delivery of humanitarian aid was a puzzle for aid agencies. In this dramatic context, the Bill & Melinda Gates Foundation and USAID launched the Haiti Mobile Money Initiative in June 2010, which aimed to speed up cash delivery to earthquake victims and help them handle cash safely.

This USD 10 million fund created an incentive for telecommunication operators and mobile money providers to facilitate the expansion of mobile money services in Haiti and jumpstart usage. In 2010, Digicel and Voila partnered with Scotiabank and UniBank to provide m-banking services.

Although the providers created infrastructure to leverage the high coverage of telcos and offer mobile money services linked to a bank account, policymakers still had to deal with the lack of regulation for an innovation such as this. Indeed, Haiti’s banking law stated that only banks (duly licensed and supervised by the Central Bank) were authorized to take deposits from the public.

Policymakers had to move quickly, and chose to allow “distance bank accounts”. In other words, financial regulators opted for a bank-led model instead of a telco one. The new Guidelines on Distance Banking recognized the importance of financial inclusion, and ensured full compliance, safety and trust for consumers, since services were offered only by regulated financial institutions.

The financial regulator ensured that financial institutions were ultimately responsible for this service. To deepen penetration of mobile money, financial institutions were allowed to use third parties (non-regulated) to provide services. Agents, super agents, POS terminals, ATMs, mobile phones and bank cards were all recognized as valid distribution channels.

The product architecture established thresholds for the amount customers could transact, and listed the transactions that were permitted. Distant bank accounts (DBAs) were used for cash-in and cash-out, transfers (between traditional bank accounts and DBA to DBA), payments, wages, and loan disbursements and repayments. Maximum balances per individual were set at about USD 220. Other limits were imposed based on the type of wallet and the specific application. For instance, Tcho Tcho mobile received approval to increase daily limits for its product.

Know-your-customer rules are implemented by agents. Agents are responsible for identifying new customers and must be trained by financial institutions. Consumer protection for mobile financial services includes requirements to disclose fees and tariffs, identify authorized agents, provide SMS or transaction receipts, a complaint system and consumer education.

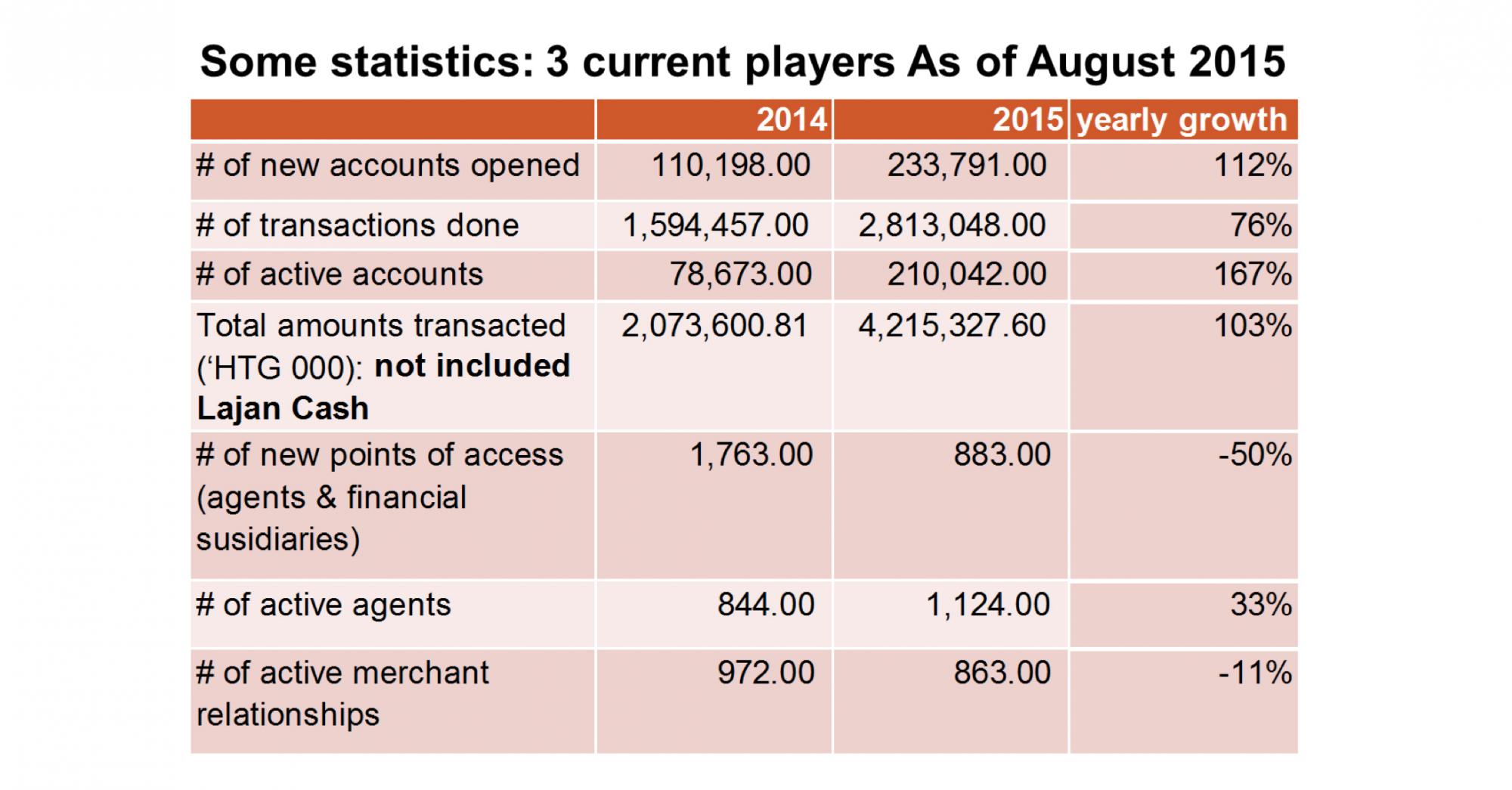

Haiti’s humanitarian emergency pushed government and NGOs to become early adopters of donor-to-person payments and social program payments. Yet even after the initial crisis, people continued to use this mobile banking product. In 2013, a new product entered the market. Banque Nationale de Crédit (BNC)’s Lajan Cash is the first mobiles wallet to be offered as an interoperable service. Transactional services are also offered and e-commerce and utility bill payments are permitted.

There have been even more innovations. In 2014, Unibank launched a new product to open distance bank accounts at any geographic location using a bank debit card. Identification is confirmed through IDs and fingerprinting. This product spread quickly, and in less than a year more than 100,000 accounts were opened.

The Haitian experience highlights the huge potential of digital financial services policies in the region. It also represents optimism and opportunity in the midst of a tragedy. Now that digital financial services are being used to meet cash needs and channel funds to people in conflict and disaster zones in different parts of the world, it is helpful to look to the Caribbean for successes and lessons.

Haiti still faces challenges. An informal economy and lack of proper infrastructure limit the speedy expansion of agent networks (via agents), and security concerns limit the capacity and willingness of agents to accept higher numbers of deposits.

Policymakers played a pivotal role in Haiti, not only in guaranteeing humanitarian assistance for Haitians, but also creating a path to development and adopting policies that address the country’s challenges. Implementing effective policies guaranteed consumer rights and facilitated innovation, which in the end created a favorable ecosystem for delivering financial services to the country’s people.

Haiti’s experience is one of a kind: policy was reformed in no time, and the impact can be seen in the high level of usage of mobile financial services today. This wasn’t a specific policy — the reforms approved by the Guidelines on Distance Banking (available in the AFI Data Portal) are a successful paradigm other AFI members can look to when humanitarian issues (natural disasters, displaced populations, conflict zones, etc.) and financial policy unexpectedly collide.

ABOUT THE AUTHOR

María Moreno Sánchez is the Alliance for Financial Inclusion’s (AFI) Senior Policy Manager.

Special thanks to Ms. Georgette Jean-Louis, Ms. Ann Valery Victor and Mr. Jean-Michele Delerme from Banque de la République d’Haiti for providing data for this blog post.

© Alliance for Financial Inclusion 2009-2024