1 April 2016

Measuring financial inclusion in one number

In an effort to track financial inclusion progress in the countries of Alliance for Financial Inclusion (AFI) member institutions, the network’s Financial Inclusion Data Working Group (FIDWG) created a “Financial Inclusion Index” to do just that. Essentially, it captures many different aspects of financial inclusion, and condenses it down to one number.

The Index was released ahead of the 13th FIDWG Meeting being held 5-7 April 2016 in San Salvador.

The index was prepared, in part, because in September 2013 AFI members agreed to strengthen the effectiveness of their Maya Declaration Commitments by defining measurable national goals and tracking their progress using AFI’s Core Set of Financial Inclusion Indicators, developed by FIDWG. The index is in line with this agreement—the Maya initiative’s Sasana Accord—which commits AFI members to using evidence and data to measure the progress and impact of their financial inclusion policies and strategies.

The Financial Inclusion Index is a tool for monitoring the progress of financial inclusion initiatives and assessing the state of financial inclusion. It leverages the AFI Core Set of Financial Inclusion Indicators for access and usage formulated by FIDWG in 2011.

The Financial Inclusion Index reduces the Core Set to a single comprehensive number to quantify and capture the state of financial inclusion in a country at a given point in time.

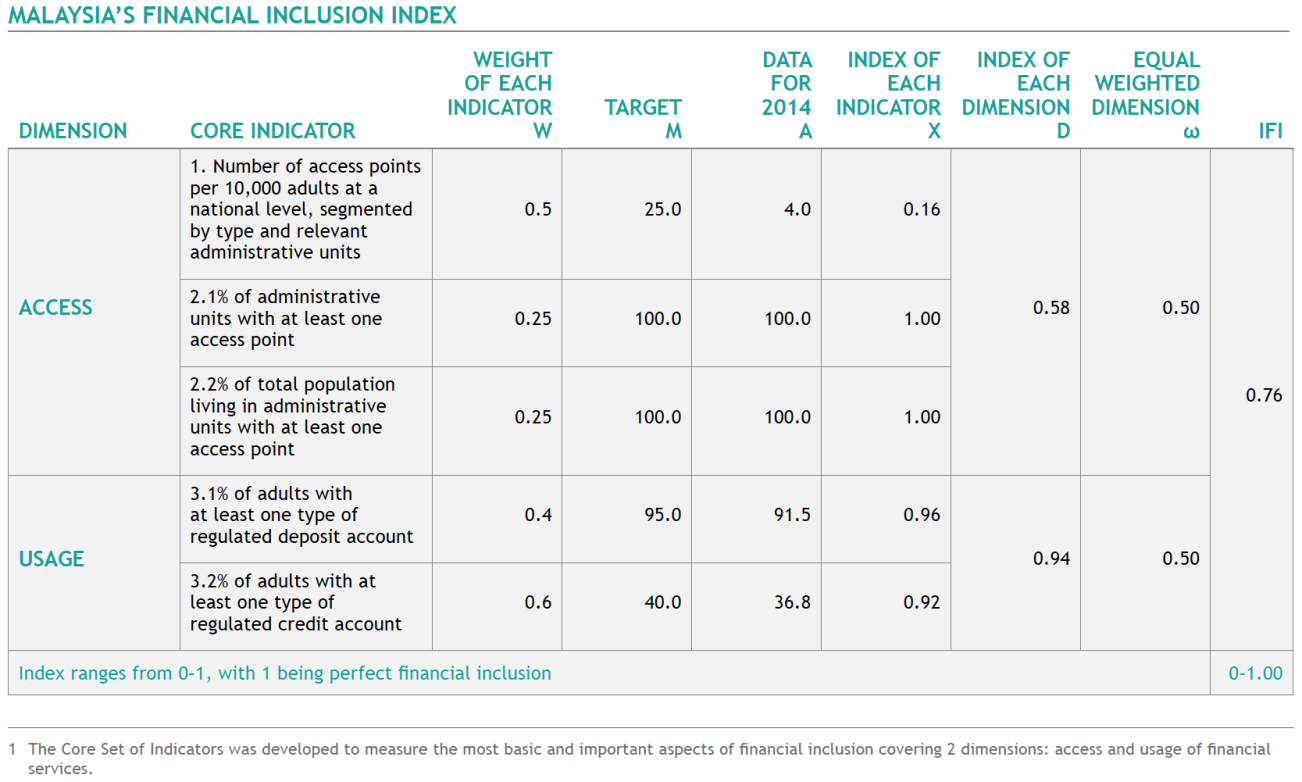

The Index also builds on the experience of Bank Negara Malaysia (BNM), a member of AFI, which developed the Index of Financial Inclusion (IFI) to measure the effectiveness of formal financial institutions in delivering financial products and services to customers all over the country.

BNM’s nationwide IFI provides a comprehensive view of the development of an inclusive financial system, while advancing the financial inclusion initiatives of national policymakers and enhancing the transformational efforts of the government.

It is important to understand, however, that the Index is a diagnostic tool and should not currently be used to rank and compare country performances. To make the Index an effective comparison tool, policymakers and data collectors should agree to a common set of indicators and targets with a standard reporting structure.

The Index was calculated through the following steps:

For ease of reporting, the Index will be embedded within the AFI Data Portal (scheduled to launch soon to members, and later this year to the public). The Index will be calculated automatically for AFI members that regularly (at least on an annual basis) report the Core Set of Indicators on the AFI Data Portal.

With the Financial Inclusion Index, AFI members are able to identify and tackle specific weaknesses in financial inclusion. The Index can also be adjusted and expanded over time to reflect changes in a country’s financial landscape, either by replacing some indicators or including more indicators and/or dimensions as they become more relevant to the national financial inclusion agenda.

To start to calculate your country’s one number, download the AFI Financial Inclusion Index here.

ABOUT THE AUTHORS

Charles Marwa is the Senior Monitoring and Evaluation Specialist at the Alliance for Financial Inclusion. Chris Hughes is the Communications Manager at the Alliance for Financial Inclusion.

© Alliance for Financial Inclusion 2009-2024